Investing in Change: How WRF Partners with CDFIs to Build a More Just Economy

Philanthropy has long been synonymous with charity, but at the Winthrop Rockefeller Foundation (WRF), we know that real, lasting change demands more than writing checks. Our goal is not simply to ask, “How can we help?” Instead, we ask, “How can we change the system so that help is no longer needed?”

WRF is a small foundation with a big vision: an Arkansas where everyone can earn a livable wage, access quality education, and build generational wealth. Funding one program at a time won’t get us there.

A $50,000 grant to a job training program might help a dozen people gain skills and find jobs … but if wages remain stagnant, childcare will remain unaffordable. Economic mobility will remain out of reach, and the cycle will continue.

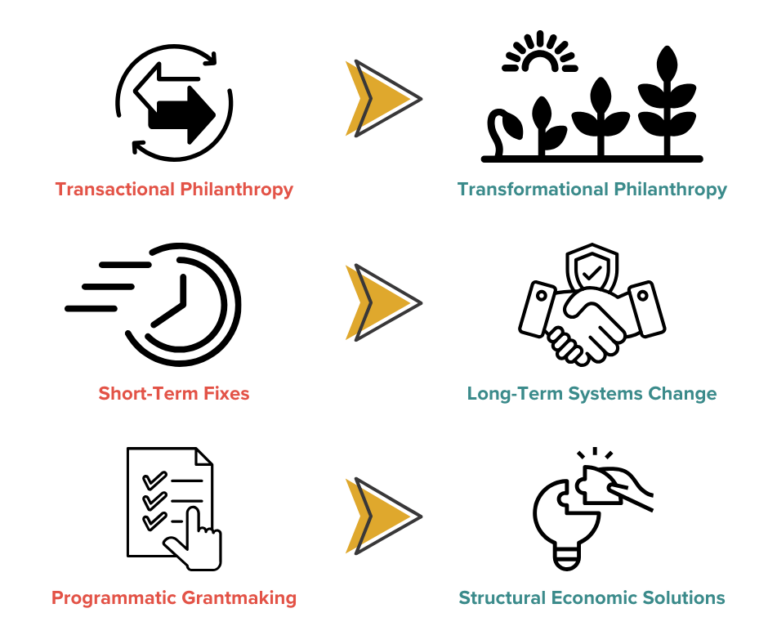

That’s why, when Dr. Sherece West-Scantlebury joined WRF nearly two decades ago, she led a strategic shift from:

- Transactional philanthropy → Transformational philanthropy

- Short-term fixes → Long-term systems change

- Programmatic grantmaking → Structural economic solutions

This evolution laid the foundation for WRF’s commitment to Community Development Financial Institutions (CDFIs) – a powerful tool for economic justice that reshapes financial systems rather than working within their existing constraints.

CDFIs as Catalysts for Economic Justice

The financial system was not designed for everyone. Traditional banks have historically failed to serve low-income families, entrepreneurs from historically underserved communities, and rural business owners, making it nearly impossible for them to secure loans, build credit, or scale their businesses. Many are left with few options beyond predatory lenders or undercapitalized informal networks, further reinforcing the cycle of economic exclusion.

CDFIs exist to bridge the gap by offering small business loans, affordable housing financing, and community investments that prioritize people over profit. While mainstream banks serve shareholders, CDFIs like Southern Bancorp, HOPE Enterprise Corporation, Communities Unlimited, Forge, and People Trust serve communities. That distinction makes all the difference.

WRF’s Approach to Funding CDFIs

To ensure CDFIs have the resources to grow and thrive, WRF takes a strategic, long-term approach to funding by deploying:

Responsive Funding – WRF builds deep, trust-based relationships with CDFIs through intentional communication, ensuring that funding aligns with real-world needs (not rigid grant restrictions.) By embedding within organizations and working alongside leaders, WRF team members gain firsthand insight into challenges and opportunities for strategic capital deployment.

General Operating Support – WRF provides unrestricted funding for core infrastructure, giving CDFIs the flexibility to grow, innovate, and adapt. By investing in staffing, technology, administration, and operational stability, WRF strengthens organizations so they can focus on long-term impact rather than short-term gains.

Patient Program-Related Investments (PRIs) – PRIs offer financing to mission-driven organizations while expecting repayment within a set, long-term timeframe. Unlike traditional grants, PRIs serve as catalytic capital, allowing CDFIs to leverage funding to attract additional investments without the pressure of short-term returns.

PRIs in Action: A Tenfold Impact with HOPE Credit Union

A powerful example of WRF’s PRI strategy is its $1M investment in HOPE Credit Union in 2015, which unlocked $10M in loan capital: a tenfold multiplier effect! This investment enabled HOPE to significantly expand lending in capital deserts where traditional banks had withdrawn. Because the PRI was structured as secondary loan capital, it strengthened HOPE’s balance sheet, positioning the organization to attract even more deposits and investments.

As HOPE CEO Bill Bynum explains:

“Winthrop Rockefeller Foundation is unique in the Deep South as a source of regulatory capital… They just have an outsized impact – both in the kind of funding that they provide and in the impact that they have in the communities we serve.”

Simultaneously, WRF actively championed HOPE’s mission by bringing funders to the table, elevating its work, and strengthening its role as a leader in community reinvestment. Investing in systems change also means leveraging our relationships to build new ecosystems and partnerships.

One of the most powerful demonstrations of this approach came during the COVID-19 pandemic when WRF brought together CDFIs, nonprofit partners, and funders to bridge gaps left by traditional institutions. This moment reinforced the importance of philanthropy’s role in connecting people, institutions, and capital to build a more inclusive financial system.

From Crisis to Collaboration

When COVID hit, the federal government launched financial relief programs, including Paycheck Protection Program (PPP) loans and Economic Injury Disaster Loans (EIDLs), to support struggling businesses. These programs were administered through traditional private banking systems, which prioritized their existing clients and fast-tracked their applications. Loan officers contacted large companies proactively and walked them through the process.

When the relief money ran out, thousands of small businesses (like barbershops, car detailers, local restaurants, and dress shops) were left behind. The first round of PPP exposed a massive systems failure: if you weren’t already part of the traditional banking system, you had no access to emergency relief.

The Second Round: CDFIs Step In

When it became clear that the first round had shut out thousands of small businesses, CDFI partners pushed for change. As a result, the second round of PPP included a dedicated pool of funding for CDFIs. However, a new problem emerged.

Even though CDFIs now had access to capital, many small business owners weren’t prepared to apply because the requirements were still built around traditional banking structures. For example, a barbershop owner or a food truck operator might not have had their finances in QuickBooks, fully up-to-date profit-and-loss statements, or the necessary paperwork to meet loan requirements

The Solution: Community Navigators

Recognizing this barrier, WRF and our partners stepped in to fill the gap. WRF funded and deployed Community Navigators, nonprofit partners already embedded in these communities. They worked directly with business owners to walk them through the necessary process. Once businesses were ready with their paperwork, Navigators made warm handoffs to CDFIs so that business owners weren’t left to navigate the system alone. In addition, WRF offered $500 grants to entrepreneurs who completed the application process with a Navigator to provide some immediate relief.

Thanks to this collaboration among CDFIs, philanthropy, and nonprofit organizations, 300-400 small businesses received funding—businesses that otherwise would have been shut out of the system.

Beyond the Crisis: Changing the SBA’s Approach

Just as important as the immediate relief, this initiative changed how the Small Business Administration (SBA) operates. The SBA realized that the Community Navigator model solved an ongoing problem: many small businesses lack the financial readiness to engage with banks. So, the SBA adopted the Navigator model nationwide, stationing Navigators at community colleges and nonprofits to continue helping small businesses become loan-ready.

What started as a privately funded, philanthropic response to a crisis became a publicly funded, systemic solution. This effort changed the way public money is deployed for long-term sustainability.

When we talk about systems change, we mean creating new, sustainable ways for more funding to reach the businesses and communities that need it most. The success stories emerging from WRF’s engagement with CDFIs show that thoughtful, equity-centered investments can transform entire ecosystems, catalyzing a cycle of community development and prosperity.

What’s next?

WRF operates with a targeted universalism approach. If we solve problems for those who have been most historically excluded and impacted, we create solutions that benefit everyone.

This philosophy is simple: tackle the hardest challenges first to get to the root issues. Currently, ALICE (Asset Limited, Income Constrained, Employed) is at the center of our policy focus. When 50% of fully employed Arkansans can’t make ends meet, it’s clear our systems are broken.

We’re fully committed to building local and statewide solutions for ALICE in Arkansas that address systemic barriers, including transportation, housing, childcare, and workforce training. But no changemaker, organization, or foundation can do this work alone. More funders, institutions, and changemakers must step up to reshape the systems that dictate who has access to wealth-building opportunities.

WRF offers a proven model for how philanthropy can move beyond charity to strategic, systemic investment:

A Blueprint for Action

- Trust the people on the ground. WRF’s responsive philanthropy efforts reflect a deep belief in local leadership. Those closest to the challenges understand the solutions best. Trusting and resourcing them is essential to maximizing impact.

- Utilize the full range of tools in the philanthropic toolkit. WRF deploys program-related investments, strategic guidance, and convening power to strengthen CDFIs and the broader ecosystem. Multifaceted approaches always go further than siloed efforts.

- Think about systems, not just organizations. Real economic justice requires policy advocacy and re-imagining how we shift capital to historically excluded communities.

Our Call to Action

Economic justice requires bold, strategic, and long-term investments that empower communities and shift power to those historically excluded from financial systems. WRF’s partnership with CDFIs provides a compelling roadmap for how philanthropy and financial institutions can drive economic equity at both the local and national levels. By trusting community-based leaders, leveraging every financial tool available, and investing in systemic solutions (not just band-aid programs), we can reshape the economic landscape and redefine what’s possible.

The question is no longer whether investing in systems change works; the evidence is clear. The question is: are you ready to join us in investing in a future where economic opportunity is truly accessible to all?

Are you a fellow funder? We invite you to get involved with the Arkansas Enterprise Capital Grant Fund (AECGF.) Reach out to AECGF@WRFoundation.org for more information.

Are you a community partner or changemaker? Subscribe to our newsletter to stay connected.